AppleInsider is supported by its audience and may well generate fee as an Amazon Affiliate and affiliate spouse on qualifying purchases. These affiliate partnerships do not affect our editorial information.

“Apple Financing LLC,” has acquired condition lending licenses and will run independently from the main company entity to ability the recently introduced Apple Pay out Later on service.

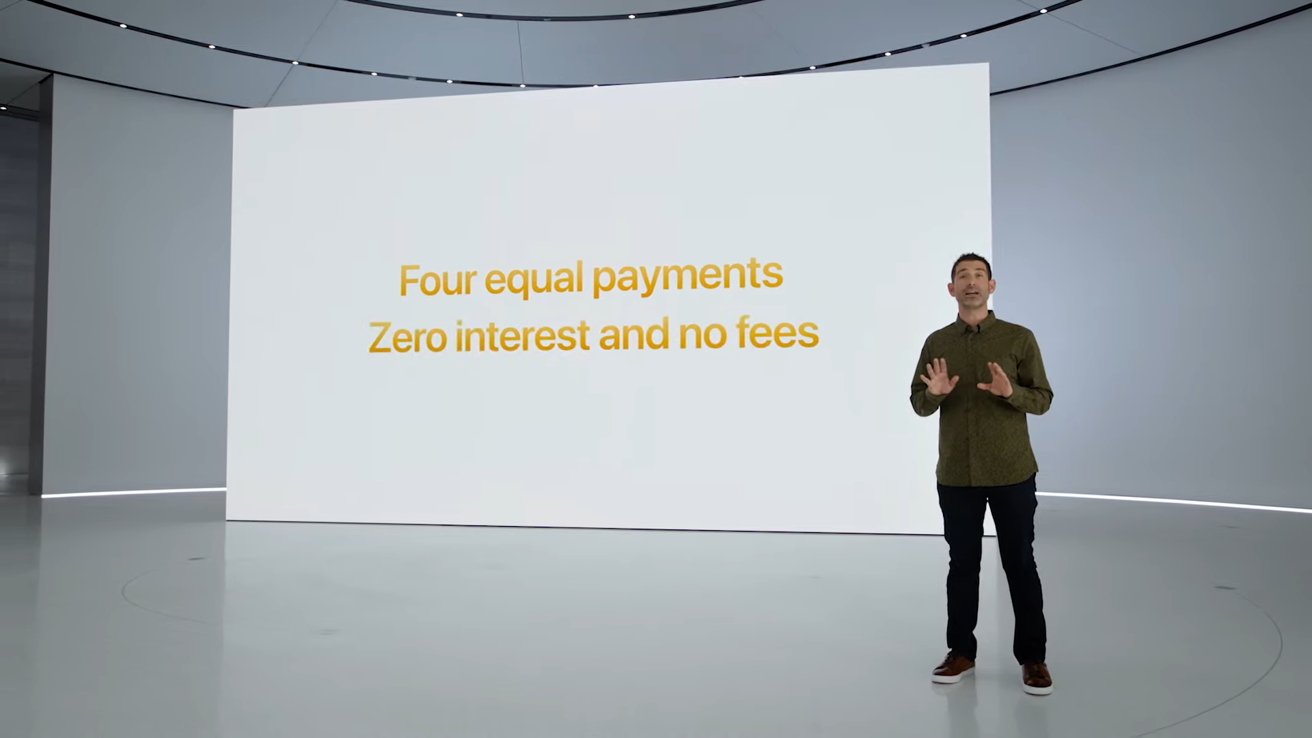

Launched at WWDC 2022, Apple Pay out Later on offers customers who are conducting a transaction through Apple Pay back to split the price into 4 payments over 6 months. The services expenses no fees or commissions.

To power the provider, Apple has proven a wholly-owned subsidiary. It has spun off Apple Financing, LLC, to manage the lending.

This marks the initial time that Apple has included loans and credit rating assessments among the other fiscal companies into the organization, in accordance to a report by Bloomberg.

The report additional that Apple has been going numerous of the fiscal expert services provided less than the Apple brand “as portion of a ‘secret initiative'” the firm internally phone calls “Breakout.” The initiative is also slated to electric power the rumored forthcoming gadget subscription application that splits the cost of new hardware into smaller month installments.

Although desire-totally free lending is not straight a resource of income from the purchaser, there are two avenues of cashflow the organization will depend on. Initially, will be simpler acquire of Apple hardware by shoppers, paid with regular installments exterior of a conventional credit rating card.

The next income avenue is transaction costs for each pay-as-you-go transaction that will be applied to the merchant. It is really not still clear what these charges will be, or if they will be in line with current credit rating card merchant service fees.

After decades of partnering with credit score card organizations for Apple-only transactions, the firm’s initial foray into payment equipment was in September 2014, with the introduction of Apple Fork out. The firm then entered the credit score card business enterprise in March 2019 in the launch of Apple Card, a end result of a partnership with banking companies firm Goldman Sachs.

More Stories

Top Cryptocurrencies for 2018: What Are the Best Bitcoin Alternatives?

Short History of Bitcoin

Bitcoin Mining & Security, Part 2